sinustech.ru Overview

Overview

How To Calculate Interest Over Life Of Loan

Use our car loan calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. To find the total interest over the life of a loan, you calculate the interest payment for each month and then add up all the interest payments. Loan Term (in years). This is the total length of the loan. Our calculator uses years to calculate the total interest accrued over this timeline. Interest Rate. Use Excel to calculate the total interest on a $45, loan for a small business making monthly payments with an interest rate of % over 15 years. Use. See how accrued interest could affect your loan balance. Even if you're not currently making loan payments, interest continues to accrue (grow). interest rate – meaning lower monthly payments and less interest paid over the life of the loan.*. Our easy application could help get you on the path to. Key Takeaways · To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months. Select calculates total interest paid on a mortgage, car loan, student loans and credit card debt. · Mortgage interest paid in a lifetime: $, · Auto loan. Using a loan interest calculator can show you how much interest you can expect to pay over the life of the loan. The Home Loan Expert team is here to show you. Use our car loan calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. To find the total interest over the life of a loan, you calculate the interest payment for each month and then add up all the interest payments. Loan Term (in years). This is the total length of the loan. Our calculator uses years to calculate the total interest accrued over this timeline. Interest Rate. Use Excel to calculate the total interest on a $45, loan for a small business making monthly payments with an interest rate of % over 15 years. Use. See how accrued interest could affect your loan balance. Even if you're not currently making loan payments, interest continues to accrue (grow). interest rate – meaning lower monthly payments and less interest paid over the life of the loan.*. Our easy application could help get you on the path to. Key Takeaways · To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months. Select calculates total interest paid on a mortgage, car loan, student loans and credit card debt. · Mortgage interest paid in a lifetime: $, · Auto loan. Using a loan interest calculator can show you how much interest you can expect to pay over the life of the loan. The Home Loan Expert team is here to show you.

life of the loan and will not change. Variable rates are interest rates that can fluctuate over time. The degree of variance is generally based on factors. P represents your monthly loan payment · a is the principal amount · r is your periodic interest rate, which is the annual interest rate divided by 12 to give you. To find the total interest over the life of a loan, you calculate the interest payment for each month and then add up all the interest payments. First we calculate the monthly payment for each of your respective loans individually, taking into account the loan amount, interest rate, loan term and. Calculate the interest over the life of the loan. Add 1 to the interest rate, then take that to the power of Subtract 1 and multiply by If the loan you are quoted has a duration of one year or more, simple interest is calculated as follows: Interest paid = Principal x Annual Interest Rate x Term. Understanding Car Loan Interest · Principal Amount x Interest Rate x Time (in years) = Total Interest · Divide the total interest by the number of months in your. If you raise the interest rate to %, that interest rate rises to $, Different lenders may calculate your monthly interest charges differently. Interest amount = loan amount x interest rate x loan term. Just make sure to convert the interest rate from a percentage to a decimal. For example, let's say. I = Total simple interest; P = Principal amount or the original balance; r = Annual interest rate; t = Loan term in years. Under this formula, you can. Calculate your total interest. Now that you have the monthly payment, you can determine how much interest you will pay over the life of the loan. Multiply the. Use this amortization calculator to estimate the principal and interest payments over the life of your mortgage. You can view a schedule of yearly or monthly. Student loan interest is calculated by first determining a borrower's daily interest rate. To find your daily interest rate, divide your annual interest rate by. Total compounded interest payable over the life of the loan = ((L.r.(n+1))/2. Formula for repayment of a loan on equal repayments. L = loan amount r = interest. Student loan interest is calculated by first determining a borrower's daily interest rate. To find your daily interest rate, divide your annual interest rate by. Interest on a loan, such as a car, personal or home loan, is usually calculated daily based on the unpaid balance. interest rate. So while your costs are higher at first, you may notice you pay less in interest over the life of the loan. On the other hand, choosing a loan. Calculating Amortizing Interest · Step 1: Divide your interest rate by the number of payments you're making in a year. · Step 2: You then multiply your result, or. The length of time you take to repay the loan can impact your interest rate, as well as how much you pay each month and in total over the life of the loan. To. Annual interest rate for this loan. Interest is calculated monthly on the current outstanding balance of your loan at 1/12 of the annual rate.

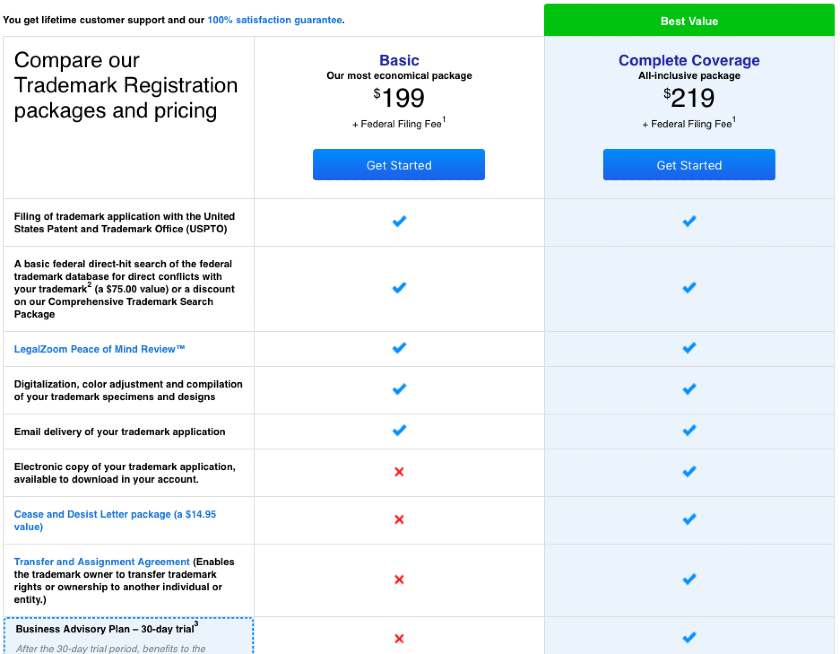

State Trademark Cost

As mentioned above, the cost of filing a new trademark application with Gerben IP includes a $1, flat legal fee and a $ government filing fee, making a. No. Registering a trademark with the Secretary of State's office does not protect it against a federal trademark or copyright. For more information on filing. There is a $15 filing fee for each name, phrase, design, or logo to be registered. Each trademark requires a separate application. The cost to file an application to register a trademark or service mark in North Carolina is $ The fee is non-fundable. Fees and Methods of Payment ; Trademark/Service Mark Application, $ per class ; Renewal, $ per class ; Assignment, $ per class ; Registrant Name or. As mentioned above, the cost of filing a new trademark application with Gerben IP includes a $1, flat legal fee and a $ government filing fee, making a. Generally, the cost can range from a few hundred dollars to thousands of dollars. START YOUR BUSINESS. Starts at $0 + state fees and only takes minutes. There is a $15 filing fee for each name, phrase, design, or logo to be registered. Each trademark requires a separate application. How much is the filing fee to register a Trademark or Service Mark. As mentioned above, the cost of filing a new trademark application with Gerben IP includes a $1, flat legal fee and a $ government filing fee, making a. No. Registering a trademark with the Secretary of State's office does not protect it against a federal trademark or copyright. For more information on filing. There is a $15 filing fee for each name, phrase, design, or logo to be registered. Each trademark requires a separate application. The cost to file an application to register a trademark or service mark in North Carolina is $ The fee is non-fundable. Fees and Methods of Payment ; Trademark/Service Mark Application, $ per class ; Renewal, $ per class ; Assignment, $ per class ; Registrant Name or. As mentioned above, the cost of filing a new trademark application with Gerben IP includes a $1, flat legal fee and a $ government filing fee, making a. Generally, the cost can range from a few hundred dollars to thousands of dollars. START YOUR BUSINESS. Starts at $0 + state fees and only takes minutes. There is a $15 filing fee for each name, phrase, design, or logo to be registered. Each trademark requires a separate application. How much is the filing fee to register a Trademark or Service Mark.

The filing fee for a new trademark registration, a renewal or an assignment is $ All applications must be fully completed and include a filing fee. How much is the filing fee to register a Trademark or Service Mark. How Much is the US Government Trademark Filing Fee? · Cost to trademark a business name under a TEAS Plus application = $ per international class · Cost to. You should budget between $ and $ when applying to the USPTO to trademark your company name federally. The USPTO website states that the following factors. GOVERNMENT FILING FEES ASSOCIATED WITH REGISTERING A TRADEMARK. The USPTO charges a flat fee of either $ or $ PER CLASS OF GOODS. This means that. Fee Schedule - Listing of all Corporations Section fees. Rev. ; Payment Form - Form for use in transmitting credit card, LegalEase, or client. The filing fee for a new trademark registration, a renewal or an assignment is $ All applications must be fully completed and include a filing fee. and $ filing fee per class code as listed on line 6, plus additional $ manual processing fee. Business Office Information. The Idaho Secretary. Trade Name, Trademark, Service Mark Registration: Filing Fee: $ Expedited Review: $ Copyright © , State of Hawaii. All rights reserved. 4) A filing fee of $ payable to the Secretary of State. Filing fees are non-refundable and non-transferable. Keep a copy of your submitted application. a fee of $50 (check made payable to the Secretary of State). . What kind of specimens are acceptable for a trademark? Labels, tags, containers. Here in New Hampshire, making an application for a state trademark registration is simple, low cost, and can be completed online. No. Registering a trademark with the Secretary of State's office does not protect it against a federal trademark or copyright. For more information on filing. The registration fee is a minimum of $50, which includes the class code requirement. Each additional class code listed is an additional $ a fee of $50 (check made payable to the Secretary of State). . What kind of specimens are acceptable for a trademark? Labels, tags, containers. A non-refundable filing fee of $15 must accompany each application for registration of a trademark or service mark. This is an examination fee. Even if the mark. FAQ - Trademarks · What is a Trademark? · How do I file a Trademark Registration? · Can I submit a Trademark online? · What kind of samples are needed with a. Filing a trademark registration application for a mark incurs a fee ranging from $ to $ per class, with additional attorney fees. The filing fee is $ Secretary of State Seal. Kansas Secretary of.

Jobs That Pay 150k A Year

what job pays $, a year. yeah that's why I follow you. okay how about you guess. all right. job works with kids and adults okay. they wear medical. Physician Dermatology - Make up to $,/annually. 1 year ago. $ Pathology Assistant - $KK per year. 6 days ago. $–$ yearly. k salary jobs in texas ; General Dentist. Dr. Big Smilez · Mission, TX · $, - $, a year. Quick Apply ; 80% of our General Managers will earn $, That means that your net pay will be $, per year, or $9, per month. Search jobs Search salary Tax calculator Salary converter. For employers. Current paycheck stubs for all jobs · Last year's tax return · Salary information for remainder of the year · Deductions info to be taken this year · Info on. Job type: Full-time. Pay: k - k USD/year. Published on: Sep 12, Apply. Scout Motors. sinustech.ru company profile. 7, K Jobs · Sales Representative Solar Company $K-$K · Senior Frontend Engineer | React, Typescript, Vue | $k - $k | NY, US · Remote Sales. What career makes kk right after college? High level CS/EE out of MIT. I have two sons doing that. One son at Apple with $k salary. k Salary Jobs in New York City Metropolitan Area (40 new) · Executive Assistant · Production Manager · Strategic Finance Manager · HR Director · Sales. what job pays $, a year. yeah that's why I follow you. okay how about you guess. all right. job works with kids and adults okay. they wear medical. Physician Dermatology - Make up to $,/annually. 1 year ago. $ Pathology Assistant - $KK per year. 6 days ago. $–$ yearly. k salary jobs in texas ; General Dentist. Dr. Big Smilez · Mission, TX · $, - $, a year. Quick Apply ; 80% of our General Managers will earn $, That means that your net pay will be $, per year, or $9, per month. Search jobs Search salary Tax calculator Salary converter. For employers. Current paycheck stubs for all jobs · Last year's tax return · Salary information for remainder of the year · Deductions info to be taken this year · Info on. Job type: Full-time. Pay: k - k USD/year. Published on: Sep 12, Apply. Scout Motors. sinustech.ru company profile. 7, K Jobs · Sales Representative Solar Company $K-$K · Senior Frontend Engineer | React, Typescript, Vue | $k - $k | NY, US · Remote Sales. What career makes kk right after college? High level CS/EE out of MIT. I have two sons doing that. One son at Apple with $k salary. k Salary Jobs in New York City Metropolitan Area (40 new) · Executive Assistant · Production Manager · Strategic Finance Manager · HR Director · Sales.

Discover top-tier careers and executive roles on Ladders, where high-paying jobs exceed $k. Join our elite $K+ Club and propel your professional and. k/Year. AI-power clean energy platform with cheap, fixed prices. Energy. Climate Adaptation · Backend Engineer. Backend Engineer. Critical Loop. Remote. 2. Instead of paying your income taxes all at once in April, you pay in smaller installments throughout the year. jobs and claim dependents. If you have. Search jobs in accounting, finance, property, HR and more across Australia including Sydney, Melbourne, Brisbane with top recruitment agency Michael Page. 49 K A Year Jobs in Illinois · Entry Level Insurance Agent (Average K) · Life Insurance Sales Agent - Earn $k+ Yr With Our Exclusive Leads! · Sales. Find tech jobs in Germany. A minimum base salary for Software Developers, DevOps, QA, and other tech professionals in Germany starts at € per year. At. Find your next role at the #1 job board for jobs with a shorter work week e.g. 4 day week at full pay. Explore remote jobs at the most flexible companies. Robust Base Salary plus Super plus industry-leading uncapped Commissions. Empowering environment that values initiative, innovation, and diverse thinking. pay, departments, job series and more options under More Filters. The Starting at $, Per Year (ES 00); Permanent • Full-time. This job. The average salary for remote positions stands at $85, per year as of now, based on more than salaries manually verified by our team at Crypto Jobs List. $K - $K (Employer est.) Easy Apply. ~~Our agents make between k and k per year. 62 jobs · Projects Manager - HVAC · C#.Net Software Engineer - Mid Level - $K + Super · Finance Business Partner | Leading Retailer | $k + super · Fresh. Civil Engineer - Drainage - (kk). Save. CyberCoders. Phoenix, AZ. $,, per year. Job Title: Civil Engineer Location: Phoenix AZ Salary: $ School Year (SY25) High School Seniors who sign an Active Duty or Chat with a recruiter to find out more. **Enlistment Bonus Source Rates (EBSR) vary. Jobs by Sector · Accounting jobs · Audit & Advisory jobs · Banking & Financial Services jobs · Construction jobs · Engineering & Manufacturing jobs · Executive Search. We've listed 18 jobs that all have the potential to pay $K+ per year. We've consulted Payscale to find the salary range for each role. K. The figures showed job creation edged down as pay gains continued Meanwhile, year-over-year pay gains for job-changers fell for the second month. At least 85, workers at U.S.-based tech companies have lost their jobs so far in the year, according to a Crunchbase News tally. pay raises for existing. Take fishermen and loggers. They can expect median salaries of under $35, a year, $23, less than the mean for all workers. Yet the fatality rate for. See all jobs ➜. Related Companies. Synaptics · Asana · Verily · AppLovin · Ambarella · See all companies ➜. Other Resources. End of Year Pay Report · Calculate.

Loan From Family Member

Everyone legally can borrow from family and friends if both parties are willing. If homeowners handle loaning money correctly, everyone can end up winning. Lending to or borrowing from family members is an extraordinarily dangerous thing to do precisely because of the way it changes relationships. Nothing in the tax law prevents you from making loans to family members (or unrelated people for that matter). However, unless you charge what the IRS considers. One of the most flexible and powerful gifting techniques is to loan money to other family members, especially in a period of low interest rates. Limiting loans to friends or family members you trust to pay back what they owe can help you avoid financial and emotional headaches later. It can be tempting to borrow money from someone you know, especially if they've offered. But there are lots of thing to consider, such as how'll they'll react. Charge a minimum Interest Rate · Select the Right Payment Structure · Consider Requiring Security · Consider the Repercussions of Loan Forgiveness · Consider the. Be sure to set expectations, draw up a contract, and make sure your spouse knows that the loan is happening. Article Sources. Ask for a plan. · Review the borrower's finances and help them set up a budget that includes your monthly repayment. · Make sure they understand this is a loan. Everyone legally can borrow from family and friends if both parties are willing. If homeowners handle loaning money correctly, everyone can end up winning. Lending to or borrowing from family members is an extraordinarily dangerous thing to do precisely because of the way it changes relationships. Nothing in the tax law prevents you from making loans to family members (or unrelated people for that matter). However, unless you charge what the IRS considers. One of the most flexible and powerful gifting techniques is to loan money to other family members, especially in a period of low interest rates. Limiting loans to friends or family members you trust to pay back what they owe can help you avoid financial and emotional headaches later. It can be tempting to borrow money from someone you know, especially if they've offered. But there are lots of thing to consider, such as how'll they'll react. Charge a minimum Interest Rate · Select the Right Payment Structure · Consider Requiring Security · Consider the Repercussions of Loan Forgiveness · Consider the. Be sure to set expectations, draw up a contract, and make sure your spouse knows that the loan is happening. Article Sources. Ask for a plan. · Review the borrower's finances and help them set up a budget that includes your monthly repayment. · Make sure they understand this is a loan.

A family loan agreement is an agreement between two family members for one to lend money to the other. With a family loan, which is sometimes called an intra-. Asking a family member for money can put pressure on that family member, making them feel as if they must provide you the loan. App for peer to peer lending and borrowing between family and friends. We help you legalize and manage a loan transaction. Our platform also helps you. An intrafamily loan can be a powerful estate planning tool because it allows you to transfer wealth to your loved ones free of gift taxes. Otherwise, the money is considered income that you can be taxed on. If your family member or friend doesn't charge the AFR, the IRS may also tax them on. Nothing in the tax law prevents you from making loans to family members (or unrelated people for that matter). However, unless you charge what the IRS considers. If the child borrows from a family member, the loan could be set up as an interest-only loan with a balloon payment due at some point in the future. From my experience, as long as it's a genuine loan and you have clear documentation, it shouldn't count as income. For the details and any. Getting a loan from family or friends can seem like a simple option. But your relationship could be affected if things go wrong. And sometimes people might. Never loan money to family or friends. When and if they don't pay you back, you will lose the relationship. Give the money as a gift if you can. Borrowing from a relative or friend can mean a lower-interest loan than you'd be able to find elsewhere. That's because you and your private lender will set the. A family loan agreement is made between a borrower that agrees to accept and repay money to a lender related by blood or marriage. A loan between loved ones has the same legal weight as a bank loan. If you are lending money to a friend or family member, you may want to get the details. Let's quickly discuss the benefits of borrowing money from a friend or family member. They are: Now let's move on to the lender's point of view to determine. Keep money in the community. No banks, loan sharks, or predatory lenders when you borrow. Relationship-based loans are only between you and members of your. Asking someone if you can borrow or share their resources. Before you approach your friend or family member with your need or request, take a short time to. That friend or family member might be willing to co-sign a loan or provide collateral if you can't otherwise qualify. Again, understand the risks of borrowing. All replies Generally speaking, small loans and monetary gifts from family members aren't considered taxable income. However, if the loan or gift is a large. Investment vs loan: A loan might be better if you don't want your friend or family member telling you what to do. · Loan vs gift: If you're not paying interest. If your friend or family member wants to give you a no-interest loan, make sure the loan is not more than $, If you borrow more, the IRS will slap on.

Current Value Of Kennedy Half Dollars

They do have numismatic value if they are Mint State. They could be worth up to x face value if they are in perfect condition (MS) and x+ face value. The photos provided may not be the exact roll you receive, however it represents the same product. FULL DATES Roll Of 20 $10 Face Value 90% Silver. JFK Half Dollars can be worth barely more than 50 cents or up to $, if you hit the rare coin jackpot. Here are a few examples of JFK Half Dollars, common. Kennedy Half Dollar 50C Coin - NGC MS67+ with Rare Plus Grade - $ Value · Silver Kennedy Half Dollar 1/2 Roll=10 coin $ Face Value · Kennedy Halves, Value Range. Kennedy Half Dollar 50c 90% Silver, MS Type Coin. $ -. $24, $ - $24, Kennedy Half Dollar 50c 40% Silver. Buy Kennedy Half Dollars from Profile Coins. Every JFK Half Dollar comes with a day guarantee of satisfaction. $ is the rounded silver value for the silver Kennedy half dollar on September 06, This is usually the value used by coin dealers when. Kennedy Half Dollars ; Enrollments Available. 23RC · 24KA · 24KB · 24XT · 24XU · ME · MF · ML · MV · MW · MY · NBA · NN ; Price. $1 - $50 · $ 10 Most Valuable Kennedy Half Dollars · P Silver Proof: $25 - $30 · S Silver Proof: $25 - $30 · S Silver Proof: $30 - $35 · S Silver Proof: $ They do have numismatic value if they are Mint State. They could be worth up to x face value if they are in perfect condition (MS) and x+ face value. The photos provided may not be the exact roll you receive, however it represents the same product. FULL DATES Roll Of 20 $10 Face Value 90% Silver. JFK Half Dollars can be worth barely more than 50 cents or up to $, if you hit the rare coin jackpot. Here are a few examples of JFK Half Dollars, common. Kennedy Half Dollar 50C Coin - NGC MS67+ with Rare Plus Grade - $ Value · Silver Kennedy Half Dollar 1/2 Roll=10 coin $ Face Value · Kennedy Halves, Value Range. Kennedy Half Dollar 50c 90% Silver, MS Type Coin. $ -. $24, $ - $24, Kennedy Half Dollar 50c 40% Silver. Buy Kennedy Half Dollars from Profile Coins. Every JFK Half Dollar comes with a day guarantee of satisfaction. $ is the rounded silver value for the silver Kennedy half dollar on September 06, This is usually the value used by coin dealers when. Kennedy Half Dollars ; Enrollments Available. 23RC · 24KA · 24KB · 24XT · 24XU · ME · MF · ML · MV · MW · MY · NBA · NN ; Price. $1 - $50 · $ 10 Most Valuable Kennedy Half Dollars · P Silver Proof: $25 - $30 · S Silver Proof: $25 - $30 · S Silver Proof: $30 - $35 · S Silver Proof: $

The Kennedy half dollar, first minted in , is a fifty-cent coin issued by the United States Mint. Intended as a memorial to the assassinated 35th. Kennedy Half Dollars · 90% Silver Composition () · 40% Silver Composition () · Clad Composition (Present) · Bicentennial Design (). Roll of 20 – $10 Face Value Brilliant Uncirculated 90% Kennedy Half Dollars ; ; ; Find the current Kennedy Halves (Proof) values by year, coin varieties, and specific grade. Find the current Kennedy Half Dollar values by year, coin varieties, and specific grade. View all on APMEX. How much Kennedy half dollars are worth: Kennedy half dollar values & coin price chart. This product is shipped as $1 in face value (two 40% silver Kennedy Half Dollars). Coins will be dated between 19and will be in average circulated. Current silver melt value* for the coins (40% Silver) is $ and this price is based off the current silver spot price of $ This value is. Kennedy Half Dollars (Date) (All). While the value of a Kennedy half dollar made in is $ today, the value of a Kennedy silver half dollar made between 19is only $ Again. GreatCollections has sold 39, Kennedy Half Dollars in the past 14 years, selling at prices from $1 to $87,, in grades 1 to The design was made by. According to the NGC Price Guide, as of September , a Kennedy Half Dollar from in circulated condition is worth between $ and $ However, on the. Coin values search results ; 50C MS67 PCGS. 50C MS67 PCGS. MS ; () 50C Kennedy Half Dollar -- Struck on a Susan B. · () 50C Kennedy Half. While there are some half dollars that you can sell for $32, and some you can buy for $32, that's true for a lot of other price points as well. 90% Silver Kennedy Half Dollars - $ Face Value · Volume Discount Pricing. Kennedy Half Dollar 50C Coin - NGC MS67+ with Rare Plus Grade - $ Value · Silver Kennedy Half Dollar 1/2 Roll=10 coin $ Face Value · (P) Kennedy Half Dollar 90% Silver Choice BU US Coin See Pics B $ Original price was: $ $ Current price is: $ 90% Silver Coins Kennedy Half Dollar Coin - $10 Face Value Bags ; Volume Pricing Tiers · 1+. $ $ $ ; Mintage · ,, ; Reviews by. Coin values search results ; 50C MS67 PCGS. 50C MS67 PCGS. MS ; () 50C Kennedy Half Dollar -- Struck on a Susan B. · () 50C Kennedy Half. ( oz of silver content for every face value dollar). BBB - Money Metals Love 64 Kennedy Halves. So I ordered $20 dollars worth of halves over 2.

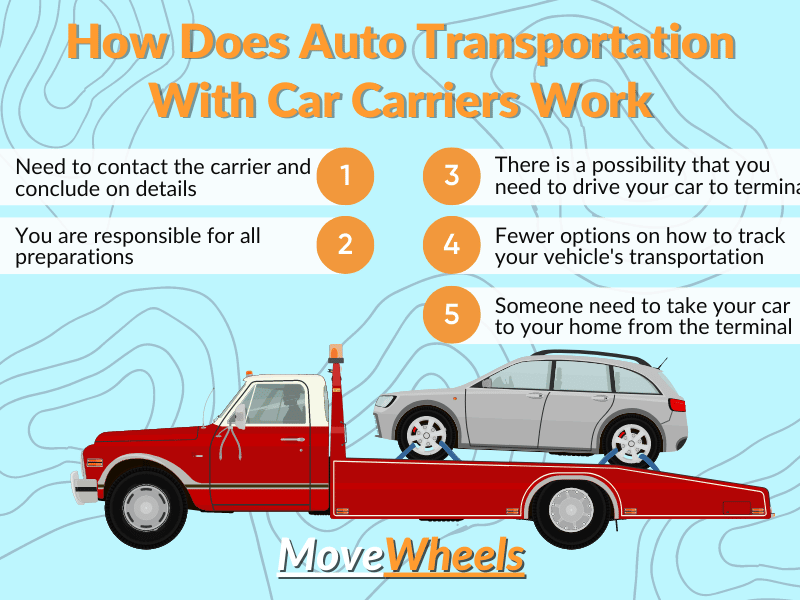

Auto Transport Broker Companies

Friendly Auto Transport is a premier auto shipping brokerage that coordinates transport for cars, trucks, vans, motorcycles, and some specialty vehicles. Shaughnessy Overland Express Auto Transport is a family-owned and operated auto transport company that has been providing nationwide shipping services for over. We transport a wide range of vehicles, including cars, trucks, caravans, vans, boats etc. Get an instant auto shipping quote or call us at () to get. The vehicle shipping companies are ranked based on the rating provided by the visitors. Higher the rating, higher the companies are ranked. Orange Auto Transport is a leading Car Transport company around the United States. We ensure complete comfort to our customers during the transit. An auto transport broker is an intermediary between you and the motor carrier that will actually transport your car. A broker designs the best strategy to. The main difference is that a broker does not own their own trucks. They find trucking companies in your area to pick up and deliver your vehicle. A carrier. The auto transport brokers do not have trucks and use a network of car transport carriers to move cars for them. So they just “sell” the customers on their. This guide explains how car hauler brokers connect people shipping cars with carriers, serving as intermediaries for efficient vehicle transport. Friendly Auto Transport is a premier auto shipping brokerage that coordinates transport for cars, trucks, vans, motorcycles, and some specialty vehicles. Shaughnessy Overland Express Auto Transport is a family-owned and operated auto transport company that has been providing nationwide shipping services for over. We transport a wide range of vehicles, including cars, trucks, caravans, vans, boats etc. Get an instant auto shipping quote or call us at () to get. The vehicle shipping companies are ranked based on the rating provided by the visitors. Higher the rating, higher the companies are ranked. Orange Auto Transport is a leading Car Transport company around the United States. We ensure complete comfort to our customers during the transit. An auto transport broker is an intermediary between you and the motor carrier that will actually transport your car. A broker designs the best strategy to. The main difference is that a broker does not own their own trucks. They find trucking companies in your area to pick up and deliver your vehicle. A carrier. The auto transport brokers do not have trucks and use a network of car transport carriers to move cars for them. So they just “sell” the customers on their. This guide explains how car hauler brokers connect people shipping cars with carriers, serving as intermediaries for efficient vehicle transport.

The 7 Best Auto Transport Leads Providers [August ] · 1. LeadDrive. LeadDrive specializes in providing high-quality leads to companies in the industry. · 2. The easiest way to determine if an auto transport company is a broker or a carrier is to go the Federal Motor Carrier Safety Administration's website. At that. Ship A Car Inc. is a professional auto transport broker specializing in all vehicle types moving services. This company works only with licensed and insured. uShip officially rates us as one of the most trusted car shipping companies in the United States. Our unrivaled number of shipments, the low ratio between. Ended up going with a company called American auto who charged $, got quotes from the asset company at like $, another broker at $ Reliable Carriers is North America's largest enclosed auto transport company. For 60+ years, we've provided white glove vehicle transport & automotive. Easy Auto Ship is the ultimate choice for individuals seeking a car transport company that truly understands their needs. One of the primary reasons for hiring. The answer is simply- someone you should avoid! An auto transport broker is a type of auto transport company that sells your car shipment order to their network. Ship It Quick has been working with TOLM/Auto Transport Broker Leads for almost a year now, and of all the lead vendors we have used, their leads consistently. We provide direct service to and from any residential or business location in Los Angeles, CA - safely delivering thousands of vehicles on a monthly basis. Best Auto Transport Brokers: Top 5 by MoveWheels · 1. Montway Auto Transport · 2. Sherpa Auto Transport · 3. uShip and CompareTheCarrier · 4. MoveWheels Auto. An auto transport broker is a type of cargo broker that specializes in the shipping and transportation of vehicles. Most vehicles shipped in the U.S. are. Sherpa Auto Transport is a fully licensed and bonded transportation broker with the U.S. Department of Transportation (DOT) as well as the agency's Federal. With auto transport from Montway, you get top-notch service and convenience. Click here to learn about our trusted services and book with the trusted name. We strive to provide the lowest possible price to move your vehicle within a reasonable amount of time. Our pricing experts consider not only supply and demand. Auto Transport Brokers ; Hot Shot en español. 44K members ; HOTSHOT TRUCKING. K members ; Car Hauler Cartel. 18K members ; Non CDL Hotshot!! K members. The Central Dispatch auto transportation marketplace allows shippers and carriers to self-manage their vehicle transportation. We offer comprehensive auto transport leads packages for auto transport business owners around the nation. We offer brokers the fresh leads they need to help. Auto transport brokers are companies or individuals that have access to a large network of carriers. They don't actually have their own fleet of trucks and as a. eShip is a broker that works with fully insured and bonded carriers. The company offers door-to-door service, vehicle tracking and the eShip Platinum Protection.

Low Risk Low Reward Investments

Rule one: Risk and return go hand-in-hand. Higher returns mean greater risk, while lower returns promise greater safety. Rule two: No matter how you choose to. Which investments are the safest? · 1. Savings bonds · 2. Treasury bonds, bills, notes & TIPS · 3. Money market accounts · 4. High-yield savings accounts · 5. Short-. 5 types of low-risk investments · 1. Treasury bills, Treasury notes and TIPs · 2. Fixed annuities · 3. Money market funds · 4. Corporate bonds · 5. Series I savings. Cash alternatives. Short-term investments easily converted into cash; little risk they'll lose value. Examplesday U.S. Treasury bills; money market mutual. 6 low-risk investments for yield seekers · 1. Certificates of deposit (CDs) · 2. Money market funds · 3. Treasury securities · 4. Agency bonds · 5. Bond mutual funds. The rationale behind this relationship is that investors willing to take on risky investments and potentially lose money should be rewarded for their risk. You. Risk-reward is a general trade-off underlying nearly anything from which a return can be generated. Anytime you invest money into something, there is a risk. Not only can the passage of time help lower your investment risk, it can potentially increase the rewards of investing. Imagine you place 1 checker on the. The level of risk is tied to the potential level of return. If an investment is not expected to earn as much, it may be considered lower risk. If you take a. Rule one: Risk and return go hand-in-hand. Higher returns mean greater risk, while lower returns promise greater safety. Rule two: No matter how you choose to. Which investments are the safest? · 1. Savings bonds · 2. Treasury bonds, bills, notes & TIPS · 3. Money market accounts · 4. High-yield savings accounts · 5. Short-. 5 types of low-risk investments · 1. Treasury bills, Treasury notes and TIPs · 2. Fixed annuities · 3. Money market funds · 4. Corporate bonds · 5. Series I savings. Cash alternatives. Short-term investments easily converted into cash; little risk they'll lose value. Examplesday U.S. Treasury bills; money market mutual. 6 low-risk investments for yield seekers · 1. Certificates of deposit (CDs) · 2. Money market funds · 3. Treasury securities · 4. Agency bonds · 5. Bond mutual funds. The rationale behind this relationship is that investors willing to take on risky investments and potentially lose money should be rewarded for their risk. You. Risk-reward is a general trade-off underlying nearly anything from which a return can be generated. Anytime you invest money into something, there is a risk. Not only can the passage of time help lower your investment risk, it can potentially increase the rewards of investing. Imagine you place 1 checker on the. The level of risk is tied to the potential level of return. If an investment is not expected to earn as much, it may be considered lower risk. If you take a.

investments along with investments that tend to be lower risk. No matter what your timeframe, discuss with your Financial Advisor about what investment. Many bonds are generally more stable than stocks and provide a steadier flow of income. However, they also typically provide a lower rate of return. High-yield. You know that you have to look for investments that provide a comfortable balance of high return and low risk. Low risk means that there is a reduced chance of. As the name suggests, low-risk mutual funds are those investment options that carry minimal risk and a stable return assurance. Investments are primarily. By nature, with low-risk investing, there is less at stake—either in terms of the amount of invested or the significance of the investment to the portfolio. Safe assets such as US Treasury securities, high-yield savings accounts, money market funds, and certain types of bonds and annuities offer a lower risk. Negative Sharpe ratios below 0 indicate the investment is "suboptimal" and should be avoided because it has very high risk and very low reward. A negative. Common low-risk investments include preferred stocks, high-yield savings accounts, certificates of deposit and Series I bonds. You should consider your. Not only can the passage of time help lower your investment risk, it can potentially increase the rewards of investing. Imagine you place 1 checker on the. Students should understand that every saving and investment product has different risks and returns. Differences include how readily investors can get their. 1. Government Bonds: Invest in government bonds, which are considered low-risk due to the backing of the government. They provide regular. Where have you heard about low risk investments? Savings accounts, cash ISAs, annuities, government bonds and protected funds are considered low risk. Students should understand that every saving and investment product has different risks and returns. Differences include how readily investors can get their. lower returns, while those that are riskier pay higher returns. You can assess the risk versus reward trade-off of stocks by looking at volatility, beta. investors limited capital appreciation with minimal risk to principal. The Portfolio is designed for investors with a very low tolerance for short-term. What is a high-risk, high-return investment? · Cryptoassets (also known as cryptos) · Mini-bonds (sometimes called high interest return bonds) · Land banking. Money market mutual funds are not guaranteed or federally insured. Cash: Risk & Return. Cash is considered a low-risk, low return asset. Cash can remain as. Many bonds are generally more stable than stocks and provide a steadier flow of income. However, they also typically provide a lower rate of return. High-yield. lower returns, while those that are riskier pay higher returns. You can assess the risk versus reward trade-off of stocks by looking at volatility, beta. With higher risk comes a higher possible return, but also a higher possible loss. If one invests in lower risk products, there is a decreased chance of.

How To Earn 6 On Your Money

There is no guarantee that you'll make money from your investments. But if Some make sure they have up to six months of their income in savings so. Certificates of deposit (CDs) are time-bound deposit accounts offered by banks and credit unions. Unlike savings or checking accounts, CDs lock in your money. Make money from your money. Compounding is a powerful investing concept that For example, you invest $1, and earn a 6% rate of return. In the. By putting money aside—even a small amount—for these unplanned expenses, you're able to recover quicker and get back on track towards reaching your larger. Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment. Put your money to work. With a Mountain America certificate, you set aside funds for a set period of time—between 6 to 60 months. Bankrate awards investing banner featuring money and an arrow pointing toward growth. Low-risk ways to earn higher interest on your savings · Bankrate. It has the potential to let you literally earn money in your sleep. So Step 6: Relax (but also keep tabs on your investments). You're now an. How long does an I bond earn interest? 30 years (unless you cash it before then). When do I get the interest on my I bond? With a Series I. There is no guarantee that you'll make money from your investments. But if Some make sure they have up to six months of their income in savings so. Certificates of deposit (CDs) are time-bound deposit accounts offered by banks and credit unions. Unlike savings or checking accounts, CDs lock in your money. Make money from your money. Compounding is a powerful investing concept that For example, you invest $1, and earn a 6% rate of return. In the. By putting money aside—even a small amount—for these unplanned expenses, you're able to recover quicker and get back on track towards reaching your larger. Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment. Put your money to work. With a Mountain America certificate, you set aside funds for a set period of time—between 6 to 60 months. Bankrate awards investing banner featuring money and an arrow pointing toward growth. Low-risk ways to earn higher interest on your savings · Bankrate. It has the potential to let you literally earn money in your sleep. So Step 6: Relax (but also keep tabs on your investments). You're now an. How long does an I bond earn interest? 30 years (unless you cash it before then). When do I get the interest on my I bond? With a Series I.

Betterment can help grow your money by making saving and investing easy. Invest in a tailored portfolio, set buckets for your goals, and earn rewards. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. investing because they don't think they earn. As of August 6, The APY will vary and may change at any time Cash investments can be a great place to have your cash earn money while you. Plan on eventually increasing your savings by up to 15 to 20 percent of your income. 6. Pick the right tools. There are many savings and investment. Real estateBuying a home is a way to invest your money and diversify your portfolio. % Enter the rate of interest you expect to earn on your investment. Make your short- and long-term goals a reality with a variety of savings options from US Bank. Open a new Elite Money Market Account today and earn a. your Android or iPhone and manage your money on your schedule. 6. Learn more. Images of the login and alerts screens of mobile banking. Savings calculators. 6 months of expenses: For couples with This means that as inflation goes up, it can eat into an already low return that you are earning on your money. Cultivate your savings. Earn % Annual Percentage Yield (APY) for 6 months with a $25, deposit from outside American National Bank*1. That means if you earn $50, a year and contribute $2, to your retirement plan, your employer would kick in another $1, It's essentially free money. The power of compounding helps you to save more money. The longer you save, the more interest you earn. So start as soon as you can and save regularly. Rest assured that you don't need to earn a million dollar paycheck to reach your goal. Savings accounts with compound interest growth will do a lot of the heavy. Your short-term savings can get used to vacation in Aruba, buy holiday gifts or pay your taxes. Less than 1 decade. You might use this money to replace your. Each composite rate is a yearly rate that applies for 6 months. Period when you bought your I bond, Composite rate for your 6 month earning period starting. They can be a valuable tool for diversifying your portfolio, allowing you to earn interest on your savings while helping reduce market risk. 6 of 6. Putting your money in a high-yield savings account is a great way to maximize your earnings and grow your money over time. But just how much can you earn. High Yield Investment Programs: Scammers claim you'll make high returns on your money if you invest with them. They say you're guaranteed to make money off the. your mortgage, or put extra money in your children's college savings fund Make a budget, and stick to it. Financial success refers not so much to earning. The moderate allocation is 35% large-cap stocks, 10% small-cap stocks, 15% international stocks, 35% bonds and 5% cash investments. CRSP was used for small-. The power of compounding helps you to save more money. The longer you save, the more interest you earn. So start as soon as you can and save regularly.

Clinical Negligence Law

If the medical practitioner fails in that duty and you sustain an injury because of it – physical or psychological - you may have a case to pursue a medical. Clinical Negligence Accreditation · ensures that clients can identify you as a legal practitioner with proven competency in clinical negligence law. 'Clinical negligence' discusses no-fault schemes and the elements of clinical negligence claims in tort. Our medical negligence solicitors provide legal support that you can trust. If you have been injured due to a medical accident, our lawyers can help get your. The Board has a dedicated Medical Negligence Unit. The staff in this Unit determines whether you have a viable case in Law and whether on the merits of your. We focus exclusively on clinical negligence claims involving serious injury, in particular spinal cord injury and brain injury. Medical negligence, or clinical negligence, is when there is a breach of duty by a healthcare professional or institute, leading to avoidable harm of a patient. 12 KBW's Cressida Mawdesley-Thomas looks at the Supreme Court's recent decision and the likely difficulties it poses to those seeking to bring secondary victim. Medical negligence, or clinical negligence, is when there is a breach of duty by a healthcare professional or institute, leading to avoidable harm of a patient. If the medical practitioner fails in that duty and you sustain an injury because of it – physical or psychological - you may have a case to pursue a medical. Clinical Negligence Accreditation · ensures that clients can identify you as a legal practitioner with proven competency in clinical negligence law. 'Clinical negligence' discusses no-fault schemes and the elements of clinical negligence claims in tort. Our medical negligence solicitors provide legal support that you can trust. If you have been injured due to a medical accident, our lawyers can help get your. The Board has a dedicated Medical Negligence Unit. The staff in this Unit determines whether you have a viable case in Law and whether on the merits of your. We focus exclusively on clinical negligence claims involving serious injury, in particular spinal cord injury and brain injury. Medical negligence, or clinical negligence, is when there is a breach of duty by a healthcare professional or institute, leading to avoidable harm of a patient. 12 KBW's Cressida Mawdesley-Thomas looks at the Supreme Court's recent decision and the likely difficulties it poses to those seeking to bring secondary victim. Medical negligence, or clinical negligence, is when there is a breach of duty by a healthcare professional or institute, leading to avoidable harm of a patient.

Medical negligence is when an injury or condition is shown to have been caused or made worse by negligent, poor care by medical professionals. Read our case. This collection looks at the latest news and comment on clinical negligence healthcare law. Patient expectation of successful clinical outcome can lead to. Bell Law Firm has extensive trial experience and has recovered hundreds of millions for medical negligence victims and their families. Enable Law is a leading clinical negligence UK specialist firm – many members of our team are not just legal experts but also have a background in. Medical malpractice is a legal cause of action that occurs when a medical or health care professional, through a negligent act or omission, deviates from. Medical negligence encompasses serious injury following negligent medical care or misdiagnosis, including catastrophic injury to children during birth. If you. Medical malpractice is a type of personal injury claim that involves negligence by a healthcare provider. Personal injury and clinical negligence law involve helping clients get compensation for injuries suffered in accidents in public or at the workplace and. Medical negligence is when an injury or condition is shown to have been caused or made worse by negligent, poor care by medical professionals. Read our case. "Clinical Guidelines and the Law of Medical Negligence" published on by Edward Elgar Publishing. Medical negligence is substandard care that's been provided by a medical professional to a patient, which has directly caused injury or caused an existing. Glossary of legal terms used throughout the MDU's guides to clinical negligence. Alternative dispute resolution. There are several alternatives to litigation. What is clinical negligence law? · Duty of care: The healthcare provider must have had a duty of care to the patient, meaning they had a professional obligation. We focus exclusively on clinical negligence claims involving serious injury, in particular spinal cord injury and brain injury. Clinical negligence The government plans to introduce fixed recoverable costs for clinical negligence claims up to £25, in April Clinical negligence law can be both incredibly complex and heart-wrenching. Cases can involve difficult medical issues for patients who suffer life-long. Do you have a medical negligence claim? · The healthcare provider must be guilty of a 'breach of duty'. This means that the care you received fell short of what. Our team is ranked in the Chambers and Legal directories and includes lawyers who are accredited for clinical negligence work by the the charity Action. The team at Bevan Brittan are efficient, organised and on-top of the issues which arise in complex clinical negligence cases. The Legal , We cover all. This is referred to as the “limitation date”. If you don't issue court proceedings before the limitation date expires you may be prevented from bringing a claim.

Rent To Own Your Own Home

With a rent-to-own home sale, the buyer does not get a loan to buy the house. The buyer makes payments to the seller, who keeps the home in his name until all. A rent-to-own home is a type of property that's rented for a certain amount of time before it is eventually bought and owned by the renter. A portion of the. Not ready for a mortgage? Divvy lets you rent your dream home now, while growing your built-in savings for a down payment. Apply for free in 5 minutes. You and the seller may agree upon a price for the home or decide to base it on future local housing market rates. The renter then pays an extra premium on top. Each month, the buyer will pay the rent, which goes toward a credit to be applied towards the purchase price of the home. If the buyer decides not to sell, that. San Antonio has a wide selection of homes available for rent-to-own agreements, and it's one of the best cities to live in Texas! A rent to own apartment is a kind of settlement in which you move in as a rent paying tenant but you have the option to buy the property later. Rent-to-own, also called renting with an option to buy, is a way to buy a home without going through a bank for a conventional mortgage. Rent to own homes are those with leases that include either an option to buy or a requirement to buy after a certain period of time. With a rent-to-own home sale, the buyer does not get a loan to buy the house. The buyer makes payments to the seller, who keeps the home in his name until all. A rent-to-own home is a type of property that's rented for a certain amount of time before it is eventually bought and owned by the renter. A portion of the. Not ready for a mortgage? Divvy lets you rent your dream home now, while growing your built-in savings for a down payment. Apply for free in 5 minutes. You and the seller may agree upon a price for the home or decide to base it on future local housing market rates. The renter then pays an extra premium on top. Each month, the buyer will pay the rent, which goes toward a credit to be applied towards the purchase price of the home. If the buyer decides not to sell, that. San Antonio has a wide selection of homes available for rent-to-own agreements, and it's one of the best cities to live in Texas! A rent to own apartment is a kind of settlement in which you move in as a rent paying tenant but you have the option to buy the property later. Rent-to-own, also called renting with an option to buy, is a way to buy a home without going through a bank for a conventional mortgage. Rent to own homes are those with leases that include either an option to buy or a requirement to buy after a certain period of time.

A rent-to-own agreement, also known as a lease to purchase and a lease option, is a real estate agreement that is a combination of a rental lease and a. There are many rent-to-own programs to choose from. In this guide, we're covering the best ones, as well as how to avoid the most common scams. The Dream America Program offers aspiring homeowners the opportunity to pick any home available for sale in their community within an approved budget. There are two main types of rent-to-own arrangements that a seller can use: a lease option and a lease purchase. Most states have consumer protection laws that. I keep seeing “rent to own” home signs in my area. I have heard this is shady but not sure how it works and how it could benefit either. Also called a lease-to-own house, the process works similarly to a car lease: Renters pay a certain amount each month to live in the house. As you make monthly payments, a portion is set aside by the homeowner as a down payment, making it easier for you to purchase the home when the lease period is. There is still a way to purchase or sell a home without getting the bank involved. It's called "rent to own homes.". Some people think it doesn't matter whether they buy a house with a mortgage or a rent to own deal. On the surface, it seems the same. There are two main types of rent-to-own contracts: lease-option and lease-purchase. Lease-option agreement provides an opportunity for you to purchase the home. The main reason is that they are able to justify higher rent. If a house should rent for $, they rent it $, but say $ a month goes towards the. rent to own, lease with option to buy, rental real estate, rental homes, homes for sale, new path to homeownership, Home Partners, Home Partners of America. This solution to home buying can have potential risks and be a bit more complicated than the traditional route of financing and purchasing a property. The rent-to-own ("RTO") contract between the lessor and the renter allows the renter to use the personal property. In return for use of the property, the renter. Discover the smart way to homeownership with Pathway! Rent-to-own quality homes and enjoy the benefits of renting while getting mortgage ready. If you're in a lease option agreement as opposed to a lease purchase agreement, renting-to-own allows you to take stock of the home, the neighborhood, etc. Rent-to-own agreements and land contracts are promises to buy/sell property or a mobile home over time. However, sellers often try to evict buyers during the. In a rent-to-own agreement, the title to the house remains with the landlord until the tenant exercises the option and purchases the property. In other words. A rent-to-own home is a property you rent with the option to buy at the end of a lease. People often consider rent-to-own options in three scenarios: First. In a "rent-to-own" agreement (sometimes called a lease-option), a landlord rents you a home and gives you the option to buy it in the future.